I Messed Up - 3 Investing Lessons I Learned The Hard Way

It hasn't been all sunshine and rainbows in investing land.

If you are not a subscriber, join 1,325 other individuals who read my personal opinion on investing, personal finance, and business. (And they enjoy a good meme.)

Markets have been showing some strength here recently.

You can come out from under that rock and check your 401k again without worrying about working till 120.

In all seriousness, it’s good to see the market stabilize a little bit.

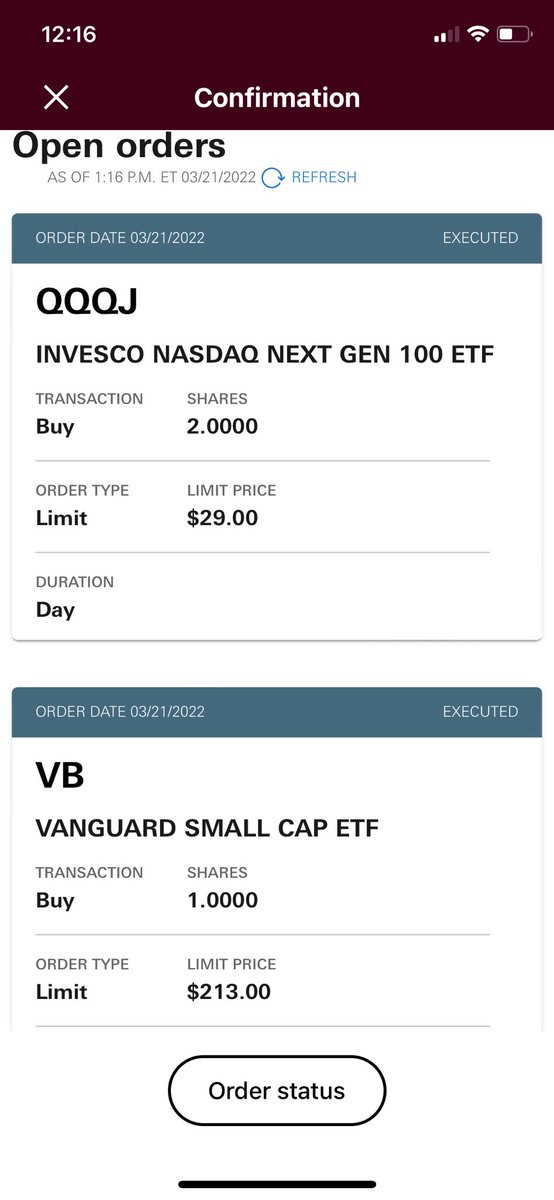

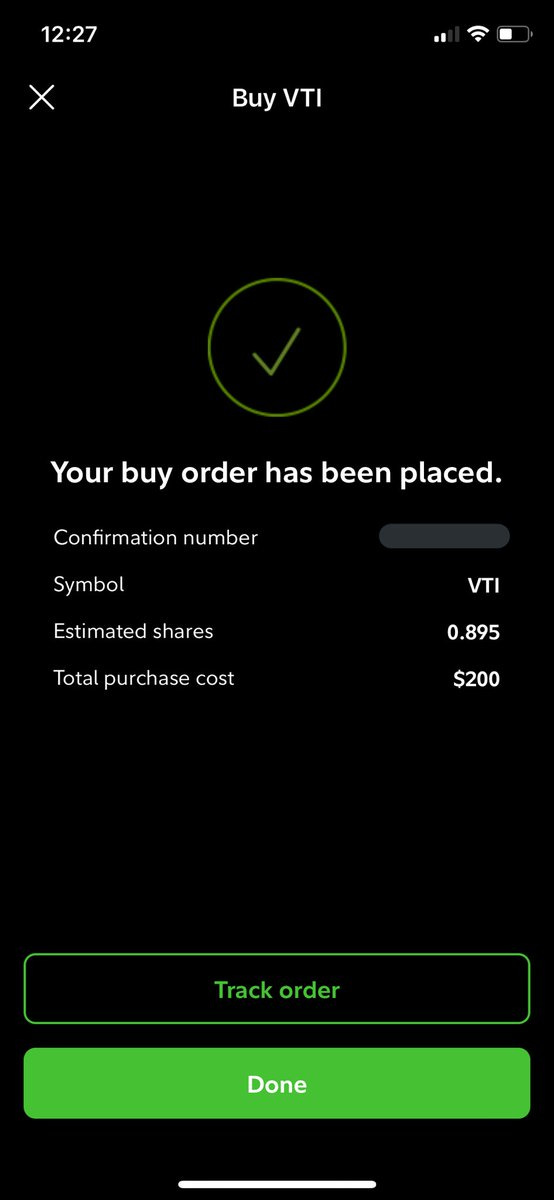

Here’s a summary of my most recent moves:

I’ll quickly cover my reasoning for purchasing these before getting into this weeks topic.

VB - Small Cap ETF - Seeking increased exposure to small caps. Current valuation of small caps is below historical average.

VTI - Total US Stock Market - Usual purchase and who doesn’t like VTI?!?!

QQQJ - Nasdaq Next Gen 100 - Beat up lately. Lowing my cost basis but still allocating it as a speculative investment.

Note: If this email is appearing in your spam you can fix that by dragging it to your main inbox.

Quote

“We can make up for lost money, but we can’t make up for lost time.” - Simon Sinek

3 Investing Lessons I Learned The Hard Way

The stock market is like a candy store.

Everywhere you look there is another strategy, trade group, or hot stock trying to get your attention.

Over my relatively short stock market career of 5 years, I have dipped my hands into a number of candy jars including options, day trading, penny stocks, ETFs/index funds, and dividend/growth investing.

Here’s 3 lessons those jars taught me.

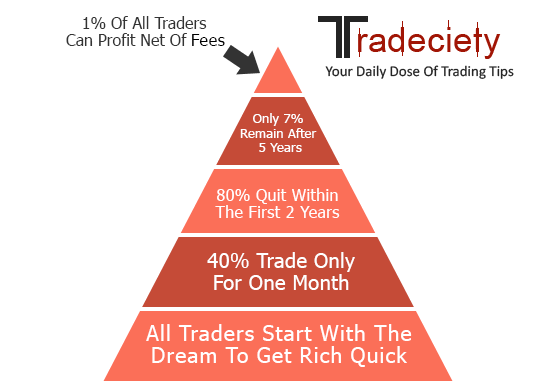

1. Short Term Trading Is Risky

Yes, trading short term is fun, sexy, and challenging.

Truth is, for 99% of people your time is better spent elsewhere as shown by this graphic from Tradeciety.

Daily swings in the market are extremely unpredictable. One has no way of knowing what economic news is going to come out, what the President might say, or what is going to happen in an ongoing war halfway across the globe.

When I look back on my time spent day trading, I would have much rather spent those hours learning a skill or finding a way to increase my income.

2. Options Are A Different Beast

Strike, spread, delta, theta, in the money, out the money, implied volatility.

This list goes on and on…

If you don’t know how to correctly use options you will likely lose money faster than the Fed can print it.

My mistake with options was that they were one of the first “candy jars” I took interest in. The money I used for option trading, and eventually lost, would have been put to much better use building a foundation for my portfolio.

Despite what I just said, options are a great tool in the hands of an EXPERIENCED investor.

One strategy I’m looking to get into is selling covered calls on stocks or ETFs where I own 100 shares. If you’re interested in this as well my friend Business Famous has a guide, Turbocharge Your Dividends, where he explains how to use covered calls.

Click the button below to check it out.

3. Lazy Investors Have It Made

The final lesson I wish I would’ve learned earlier is that lazy investors have it made.

For example, investors who bought and held the S&P 500 over the last 10 years outperformed 85% of large-cap portfolio managers. (CNBC)

They buy consistently, sit back, and let the market do the work for them while they focus on other areas of life.

Whether it’s using dividend stocks, growth stocks, Roth IRAs, or ETFs/index funds buying and holding is your best friend.

Especially if you are young, time is on your side.

Conclusion

One doesn’t have to do anything revolutionary to be a successful investor.

Build your foundation first, stay consistent with your long term plan, then dabble with that risky strategy if you want…or don’t.

Remember, if it sounds too good to be true, it probably is.

Memes

Resources:

M1 Finance - Open an account and get $50 free when you make a deposit of $100 or more.

Simply Invest With ETFs - Learn the in’s and out’s of ETFs and why they are the simplest and most effective way to invest.

Turbocharge Your Dividends - Generate extra income by selling covered calls on your stocks and ETFs.

Tweet Hunter - Automate your Twitter and build an account that will pay you $100 a week.

Personal Capital - Track all of your investments in one place.

Disclaimer: Nothing in this email is intended to serve as financial advice. Do your own research. I’m just a guy online who likes writing about money and investing.